Achieve your goals

Palisades Funding, Inc. uses a hands-on approach to every transaction. Our experience and high standard of operations are the keys to success. Below are a few of our recently closed transactions and development projects.

-

- Ground up construction

- 4450 sq. ft.

- Infinity swimming pool

- All new modern amenities

- 180 degree views from Downtown LA to Santa Monica bay

- One of the best views in Palisades.

-

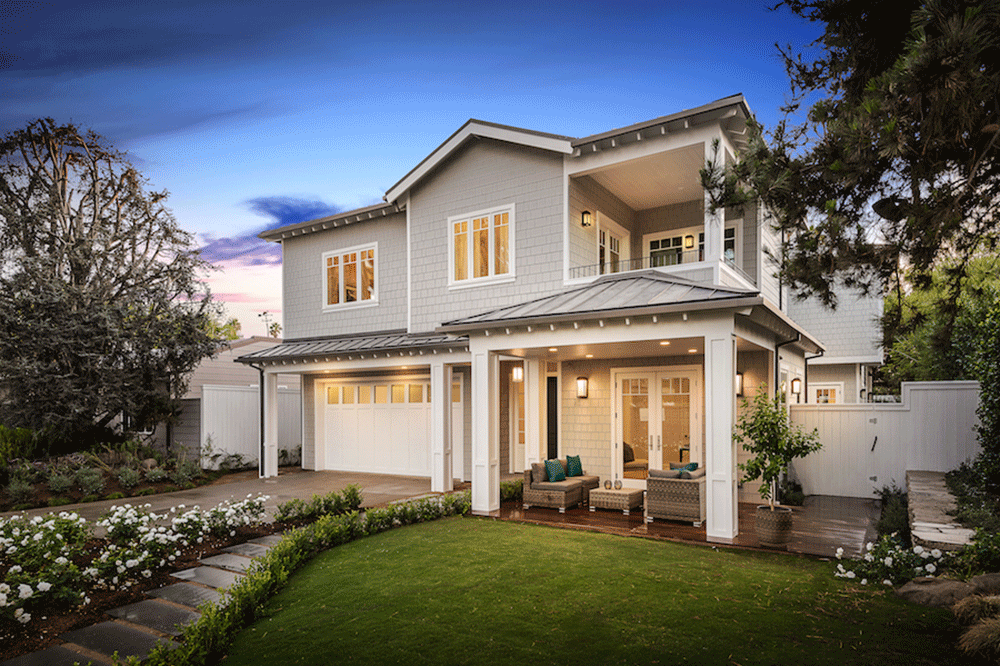

- Complex acquisition & construction financing

- Conventional & Private party loans

- Acquired property complete with plans

- 5,400 Sq. Ft.

- 5 Bedrooms

- Project completed

- Sold within two weeks of listing

-

- Adding 2,500 Sq. ft.

- Total finished product will be 10,000 sq. ft. of livable space

- Swimming Pool

- Spa

- Spacious backyard with stunning city views

- Home Gym

- State of the art media room/theater

- Newly added gate to enter the property for increased privacy

- Expand ocean and city views

- Create an indoor/outdoor living environment

- Adding 2,500 Sq. ft.

-

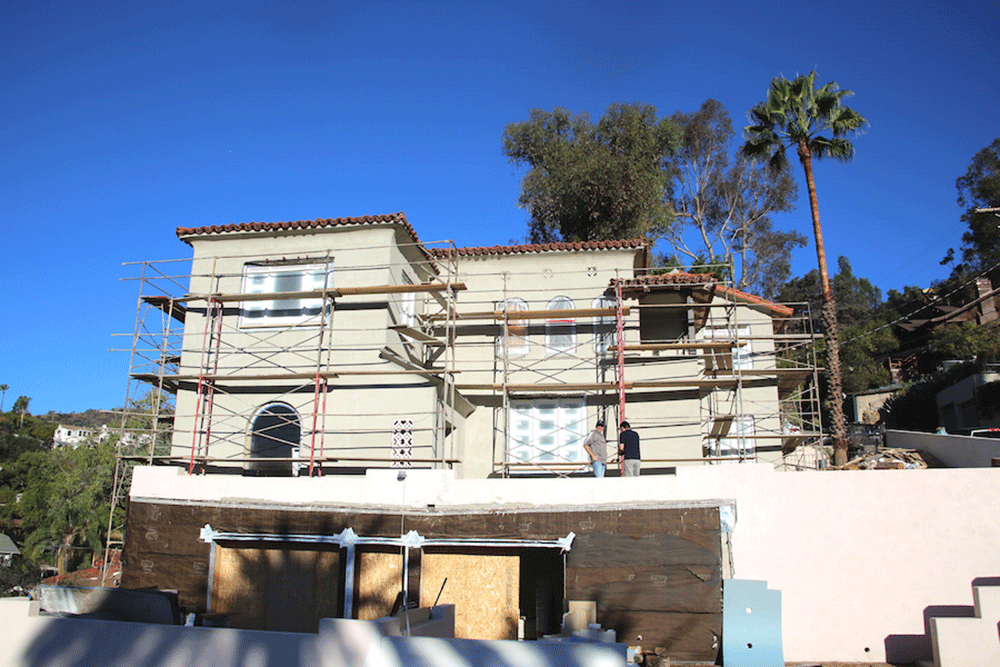

- Extensive Modern Remodel

- 5,800 square feet

- Adding second story

- All new modern amenities

- Anticipated completion Spring 2018

-

- Debt & Equity Financing

- Nearly 10,000 square foot mixed use building

- 1st floor commercial

- 2nd floor residential

-

- Purchase Price $4,630,000

- Ground up construction

- 7,800 square foot home

- Breathe taking views

- Anticipated completion mid- summer 2018

-

- Mixed-use property

- Commercial on bottom

- Residential on top

- Rennovation

- 7 Units total:

- 4 Residential

- 3 work/live

- 8,400 square foot

- Mixed-use property

-

- Funded financing

- 7 units

- USC Student Housing

Palisades Funding, Inc. uses a hands-on approach to every transaction. Our experience and high standard of operations are the keys to success. Below are a few of our recently closed transactions and development projects.

-

Property Details:

1st Trust Deed

$1,350,000 Construction financing with disbursements

9.90% Interest Only Payments

12 Month Term

Major Remodel & Adding Square Footage to existing home

-

Property Details:

2nd Trust Deed

$150,000 Bridge Loan

11.5% Interest

12 Month Term

Cross Collateralization

Loan used for Plans & Permits for new construction. Single Family Residence.

-

Property Details:

2nd Trust Deed

$1,500,000 Bridge Loan

11.5% Interest

12 Month Term

Foreclosure Bailout

Interest and principal balance reduction on 1st Trust Deed

-

Property Details:

1st Trust Deed

$1,200,000

10% Interest

12 Month Term

Property acquisition loan

-

Property Details:

2nd Trust Deed

$245,000 Bridge Loan

15% Interest

12 Month Term with interest reserve for monthly payments

-

Property Details:

Construction Financing with disbursements

$3,100,000

9.5% Interest

12 Month Term

Ground Up Construction

-

Property Details:

2nd Trust Deed

$200,000 Bridge Loan

9.99% Interest

12 Month Term

Cross-collateralization

Funds used to complete construction

-

Property Details:

2nd Trust Deed

$500,000 Bridge Loan

12% Interest

12 Month Term

Partial Monthly Interest with interest accrual

-

Property Details:

1st Trust Deed

$800,000 Acquisition Financing

10.5% Interest

12 Month Term

Assisted borrower in obtaining conventional financing